Executive compensation is more than a negotiating tool—it’s a strategic lever for growth, talent retention, and staying competitive. Knowing what your executives are worth can make all the difference between landing top talent and losing them to a competitor.

Riviera Partners’ 2025 Executive Compensation Report, exclusively available to Riviera’s client and partner network, offers valuable insights into the real salary, bonus, and equity packages tech companies are offering for leadership roles across VC-backed, PE-backed, and public companies.

Rising Demand for AI Talent Drives Compensation Trends

One of the most significant shifts in the tech hiring market is the growing demand for AI and data-driven leaders. AI leadership roles, such as Chief AI Officer and Head of AI Product, are commanding premium compensation packages. In fact, AI-related leadership roles are often compensated at higher total compensation levels than traditional roles like CTOs or CPOs.

This shift is not just driven by the rise of AI technologies, but by the strategic importance of having executives who can integrate AI into products, processes, and platforms. As AI adoption accelerates, the need for specialized leadership capable of driving AI initiatives has never been more critical. Tech companies are seeking AI-savvy executives who can lead innovation, scale AI infrastructure, and ensure the responsible deployment of AI technologies.

Compensation Trends in VC-Backed Companies

- Equity-Rich Offers: Base compensation in VC-backed companies has remained stable, particularly in Seed and Series A firms. Most early-stage companies continue to offer equity-heavy packages to win talent. For example, in Seed and Series A firms, base salaries are generally lower, but equity grants average 1.2%.

- Even More Incentive: Sign on bonuses for Series A+-stage executives now average 14% of their initial salary.

“Equity-heavy packages are dominating in early-stage VC-backed companies, while more mature startups are increasingly offering customized comp packages to attract AI and engineering leadership.”

Eoin O’Toole

Managing Partner, Venture

Shifting Trends in PE-Backed Companies

- Performance-Linked Compensation: In the private equity sector, compensation packages are increasingly tied to performance, with equity compensation tied to transformation milestones and long-term company growth. Bonus structures often focus on EBITDA and operational efficiency, rewarding leaders who drive measurable results.

- M&A Experience Is a Premium: Executives with experience in mergers and acquisitions (M&A) are commanding a significant premium in compensation, especially in the PE space. These leaders are highly sought after for their ability to manage transitions and drive growth.

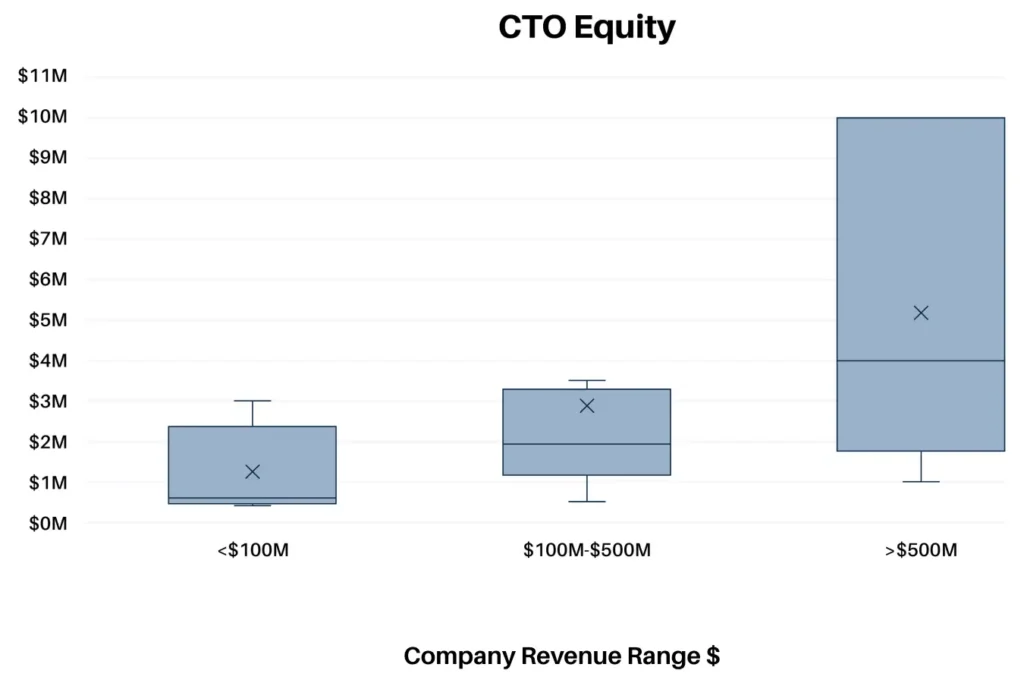

Emphasis on equity

The average equity package for CTOs at PE-backed companies has risen to as much as $6M.

Public Companies Focus on Operational Efficiency

- Lean Teams and High Expectations: Despite flat base salaries and annual bonuses across many public companies, there is a noticeable shift in leadership expectations. Executives are now expected to deliver greater enterprise-wide impact, particularly in roles focused on technology modernization and platform innovation.

- AI and Data as a Strategic Advantage: As public companies continue to integrate AI into their operations, there is an increasing emphasis on leaders who can drive data strategy and AI innovation. These leaders are often compensated with a mix of base salary, equity, and performance-based incentives.

Bonuses: The Cost of Doing Business

100 percent of executive placements at public companies with market caps below $2M and above $10B received annual bonuses.

Company Market Cap Range $

EMEA’s Growing Focus on AI and Talent in Emerging Markets

- AI Integration Is Accelerating: In EMEA, companies are rapidly shifting to integrate AI into their leadership teams. There’s a noticeable focus on candidates who can bridge technical expertise with business strategy, particularly in product and engineering roles.

- Locality and Proximity Affecting Hiring Approaches: There is renewed emphasis on local presence, with many firms preferring candidates based near key hubs like London, Berlin, Paris, and Barcelona. Southern Europe is emerging as a source of strong talent, particularly in engineering and product.

“Top candidates are all in on AI. There is a sense that the shift we are seeing will be historic and candidates don’t want to look back and realize they were on the sidelines.”

Glenn Murphy

Managing Partner, EMEA

The Pressure to Attract and Retain Top Talent

Companies today face heightened competition for executive talent, and many are feeling the pressure to improve their compensation offerings.

The most competitive firms are shifting toward blended packages of cash and equity—with an increasing focus on performance-based incentives. This approach enables companies to attract top leaders while aligning their compensation structures with long-term business goals. The report also reveals that equity compensation is becoming more variable in VC-backed and public companies. As businesses navigate economic volatility, compensation packages are more often tied to measurable business outcomes such as AI-driven innovation, platform modernization, and cost-saving goals.

Economic Uncertainty Influences Public Companies’ Compensation Strategies

The report also reveals how public companies are adjusting their compensation structures in response to ongoing economic volatility. With concerns around high interest rates, potential tariff impacts, and a cooling S&P, many public companies are becoming more selective in their hiring, prioritizing executives who can deliver measurable results quickly. The decline in market caps is impacting how much equity companies can offer, and it’s driving a greater emphasis on performance-linked bonuses and cash-heavy offers.

Additionally, C-suite executives—particularly those in product, engineering, and platform leadership roles—are now more likely to have their compensation linked to enterprise-wide impact rather than just company growth. Companies are focusing on clarity around equity mechanics, with more companies offering downside protection and liquidity timelines to appeal to candidates cautious about market volatility.

About Riviera Partners

Riviera Partners is a global leader in executive search, specializing in placing high-impact technology executives across key roles in engineering, product, AI, and design. Our data-driven approach and deep expertise help companies secure the leadership talent that drives innovation and growth.