When a venture capitalist firm evaluates a company to determine its potential they look at a variety of factors. Some of those are hard figures which can demonstrate the on the book value of the enterprise. However the intangible elements – personality, philosophy, focus, and drive – are the real metrics which can make a difference when calculating whether a business is worthy of investment.

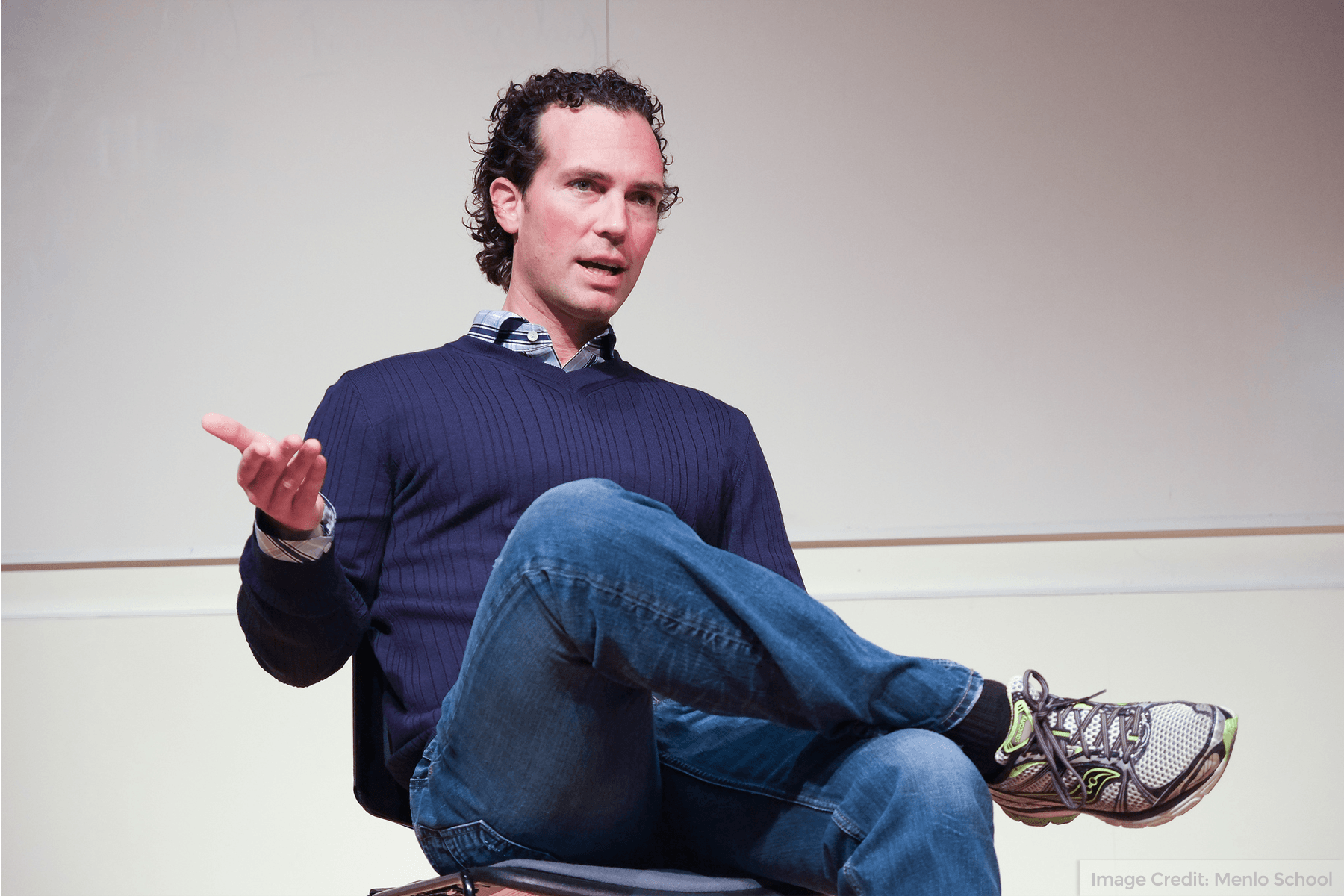

A group of up and coming industry professionals recently had a chance to discuss this topic with Mike Abbott in an intimate fireside chat. An entrepreneur and leader in the world of technology, Mike has been involved in the development of high performance products at Palm, Microsoft, and Twitter, and is currently managing investments for Kleiner Perkins Caufield & Byers. He was able to share some valuable insights into what VC’s are really looking for.

In some cases, ostensibly solid, profitable businesses are not the best choices for venture capitalist investments. It’s a problem of qualitative versus quantitative analysis. Some companies look good on paper, but they don’t have the potential for high profit returns that other innovative organizations have. It’s also difficult to evaluate a startup based entirely on numbers since cash flow is often dictated by who they are negotiating with at any given moment.

One of the things that Abbott stressed was the importance of the people involved in the start up. Venture capitalists are trying to see the big picture, and when they look at a company they are evaluating whether it can be a meaningful, stand alone business. The goals and philosophies of those involved will determine the focus of the organization, which will in turn establish the potential impact it can have on its industry.

A common mistake that companies make is skewing equity too sharply towards the owners. If the initial team fueling the startup has no share in the organization, then there will be no employee retention if they are acquired. From a venture capitalist’s point of view that removes the majority of the potential profitability from the organization.

Venture capitalist firms use a variety of metrics to determine the viability of a company for investment. Some of these involve hard numbers, but often the philosophy, focus, and personality of the people involved are paramount to their fluctuating finances. The most important thing is that the business has a viable goal, with a talented team that will be able to achieve success.

Riviera regularly hosts fireside chats with some of the leading minds in tech. Recently a group of up and coming industry professionals had the chance to sit down with Michael Abbott of KPCB – this is the third of a series of posts recapping key insight.